Mortgage Interest Rate Vs Apr Calculator

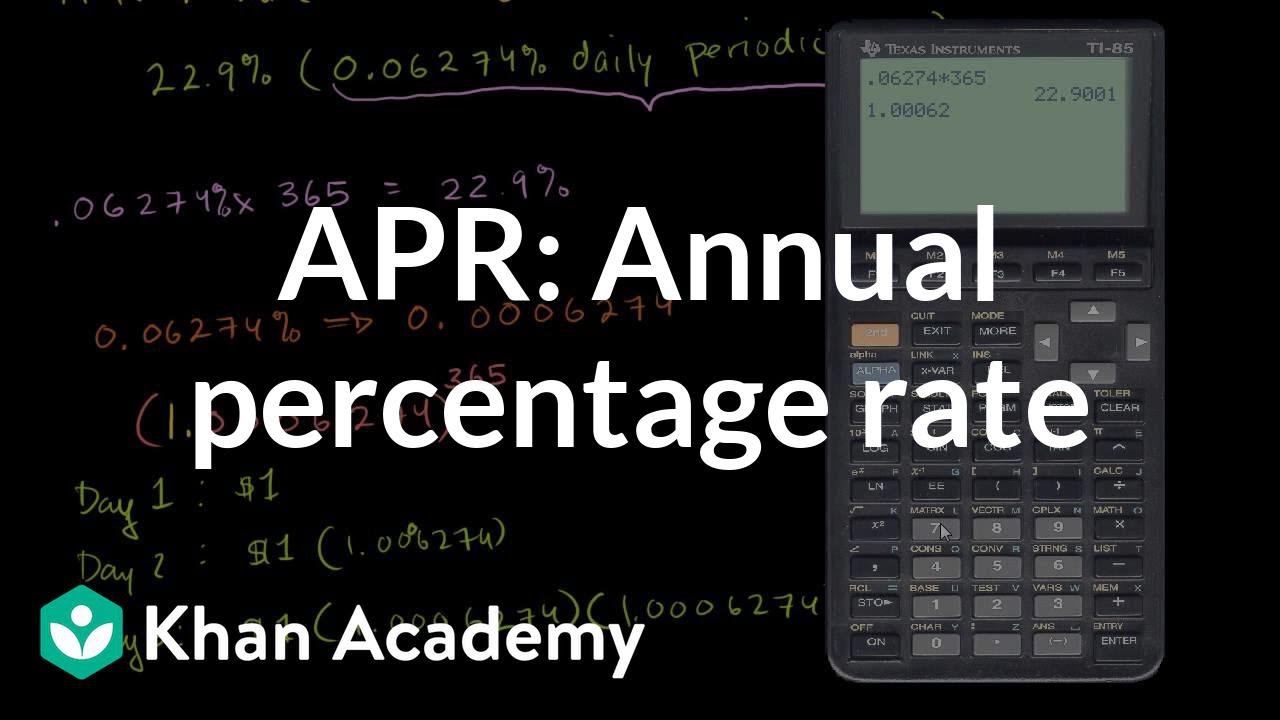

Apr on adjustable rate mortgages that do not permit negative amortization.

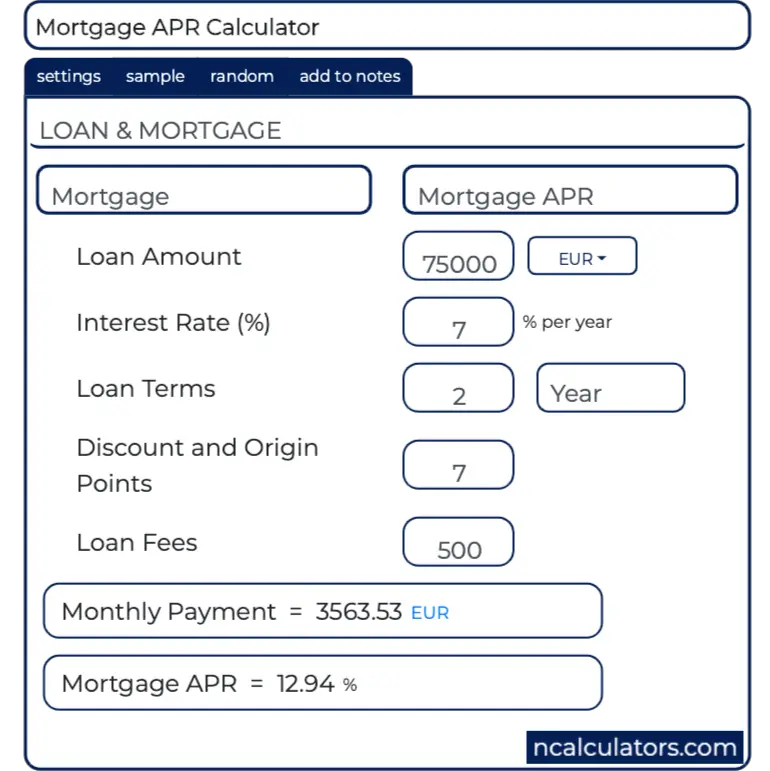

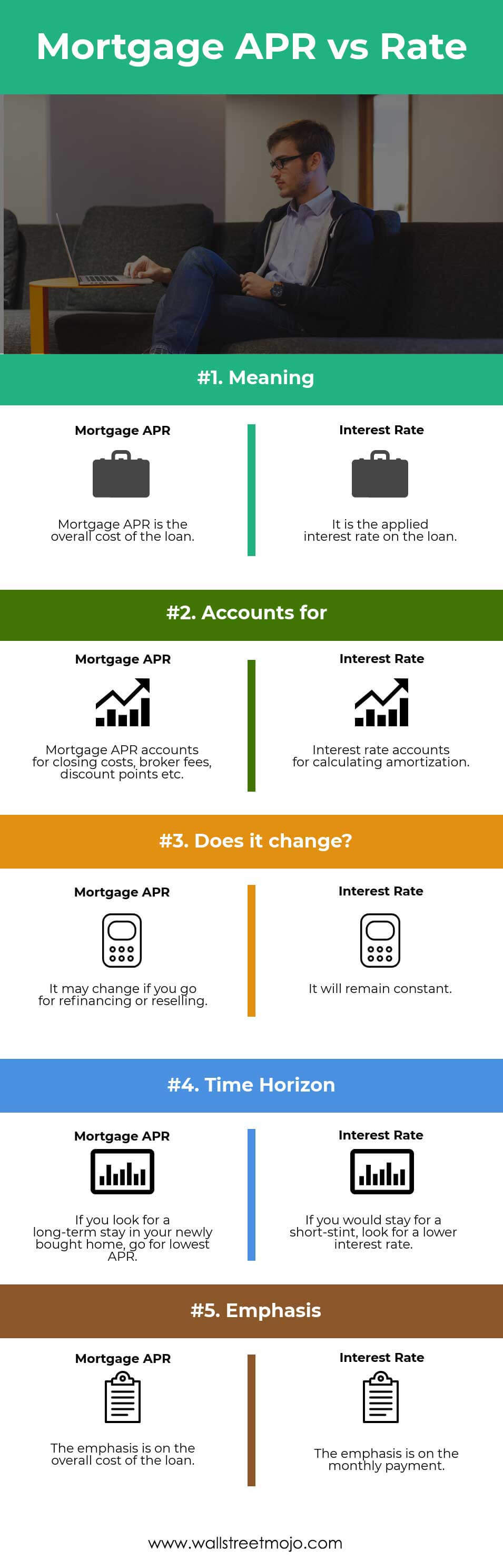

Mortgage interest rate vs apr calculator. Like an interest rate the apr is expressed as a percentage. The annual percentage rate apr on a mortgage is a better indication of the true cost of a home loan than the mortgage interest rate by itself. The rate can be variable or fixed but its always expressed as a percentage. The advertised mortgage rate x is 450 but requires that two mortgage points be paid it also has 2000 in additional closing costs which pushes the apr to 4838.

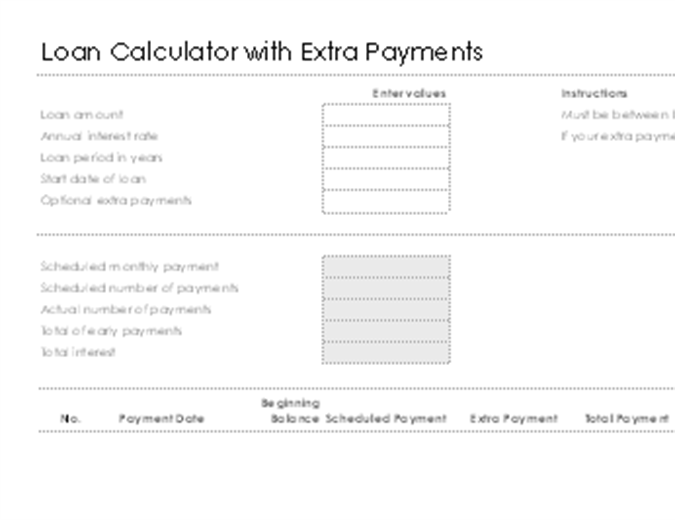

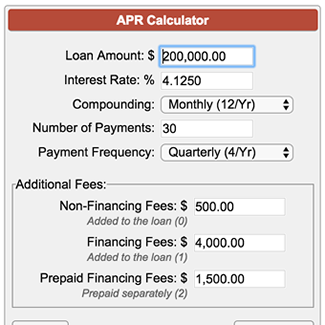

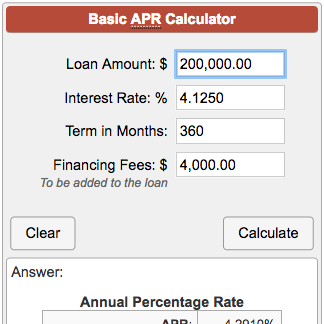

Lenders loan officers and mortgage brokers who need to get it right can use the following three calculators. The annual percentage rate represents your total cost of getting a mortgage. The interest rate is the cost of borrowing the principal loan amount. Lenders have a strong interest in calculating the apr correctly because if they dont they are exposed to legal liability.

Youll also want pay attention to other costs of the loan that arent included in the apr. Interest rate refers to the annual cost of a loan to a borrower and is expressed as a percentage. Apr on fixed rate mortgages. Meanwhile advertised mortgage rate y is offered with no points and just 1000 in closing costs so the apr is 4836 just below that of mortgage rate x.

This mortgage apr calculator takes all of that into account to determine what your apr will be on a home loan. They might be used interchangeably but an apr and an interest rate arent one and the same. The interest rate represents the cost you pay over time to buy that loan. The apr takes into account not only the mortgage rate but also things like closing costs discount points and other fees that are charged as part of the loan.

/annual-percentage-rate-apr-315533_byexcel_FINAL-4e3f58ac2743412cbcb0b3aadf2107f2.png)

/annual-percentage-rate-apr-315533_byexcel_FINAL-4e3f58ac2743412cbcb0b3aadf2107f2.png)