Car Leasing Vs Buying Cash

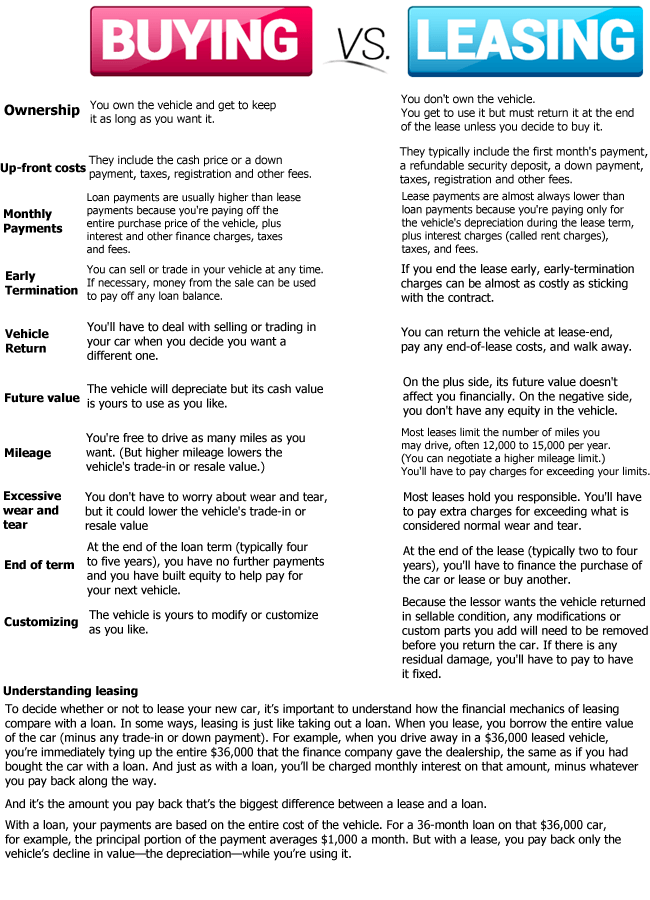

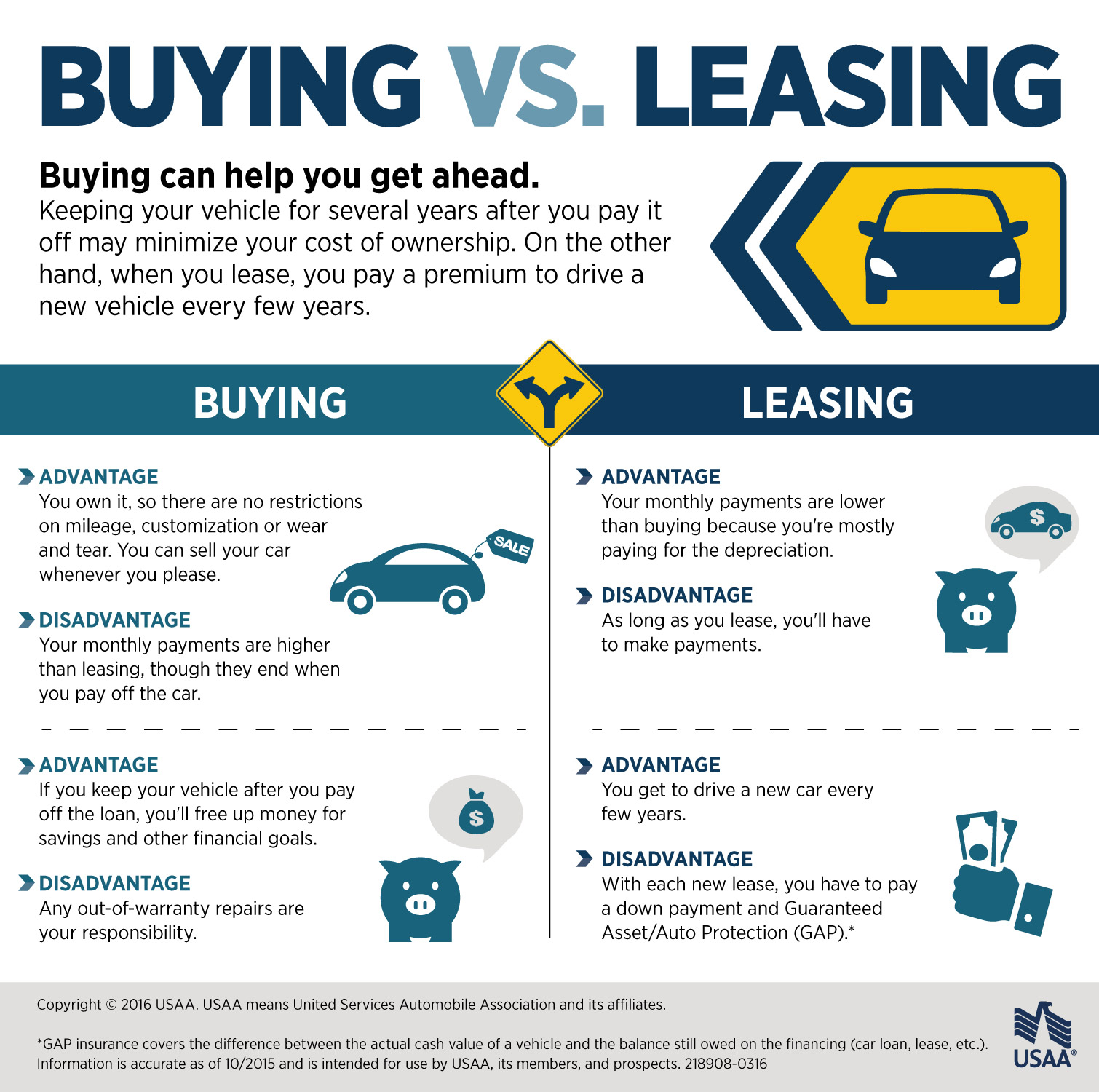

Buying a new car the choice between buying and leasing has often been a tough call.

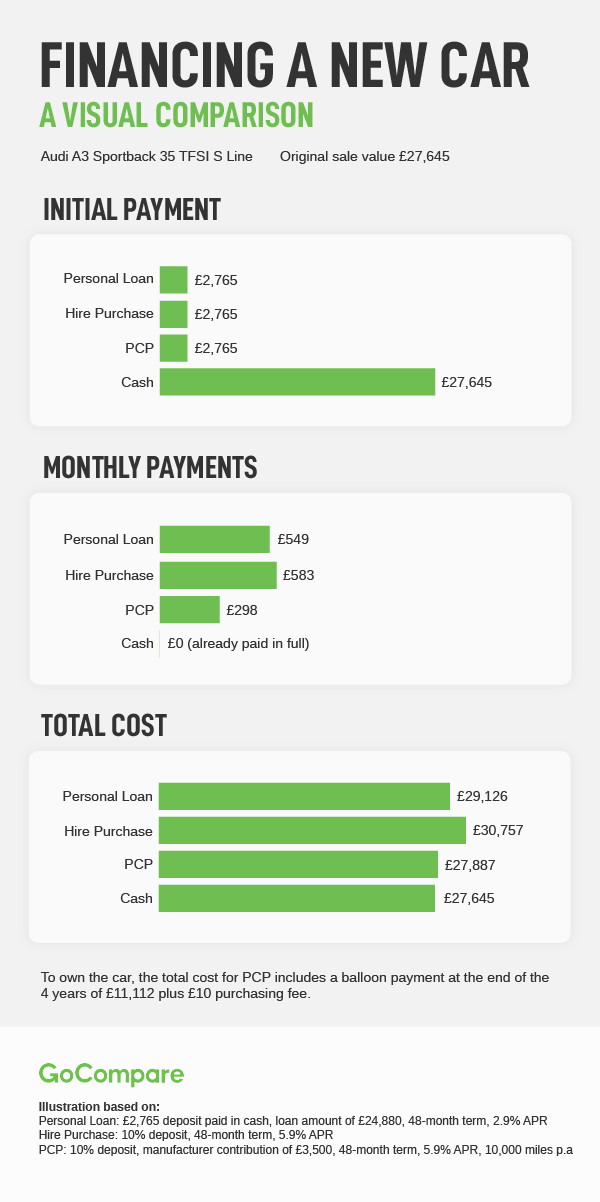

Car leasing vs buying cash. Nerdwallets decision quiz will help you match your lifestyle and preferences to the right car financing choice. The cash you put into a lease for a down payment monthly payments and any extra fees and penalties go. The difference is even smaller when comparing leasing versus financing with a loan. The lease seems like a better arrangement for me but most sources suggest that the lease is almost always a bad deal relative to buying.

Historically most people finance their cars some lease and a very few pay with cash. Myautoloan image widget theres more than one way to get behind the wheel of a new car. But for those who truly just want to know whether buying or leasing will be the best deal over the long term we present our buy vs lease calculator. Now you need to figure out the right way to pay for it.

I can buy the car without a loan. Summary in a nutshell leasing makes it easier to get more car for less money. On one hand buying involves higher monthly costs but you own something in the end. On the other a.

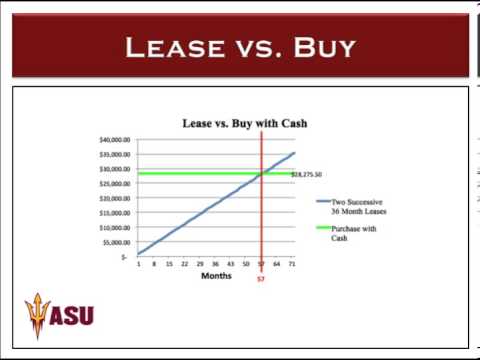

You can go the traditional route of buying your next vehicle and financing much of the purchase price or you can lease a new car. If you are considering a brand new car the buy vs lease calculator will help you weigh the options. Update with more details. Answer 7 questions to find.

If youre new to the car buying game the major difference between leasing a car and financing a car is that leasing is paying for only a portion of the car whereas financing a car is paying for all of the car. When leasing is compared to buying this new car with cash the additional cost of leasing is only about 2000. This is because you only pay for the use of the car for two or three years instead of paying for the vehicle itself. Lease or buy a car.

Should i buy the car with cash or go ahead with the lease. What am i failing to consider insurance additional liability.

/pros-and-cons-of-leasing-vs-buying-a-car-527145_FINAL-acec513303ff4fe4ab3d3e7a5c747d77.png)

/pros-and-cons-of-leasing-vs-buying-a-car-527145_FINAL-acec513303ff4fe4ab3d3e7a5c747d77.png)

/pros-and-cons-of-leasing-vs-buying-a-car-527145_FINAL-acec513303ff4fe4ab3d3e7a5c747d77.png)

/pros-and-cons-of-leasing-vs-buying-a-car-527145_FINAL-acec513303ff4fe4ab3d3e7a5c747d77.png)

/GettyImages-547497667-56c4c1c13df78c763f9e4698.jpg)